Why Planned Giving?

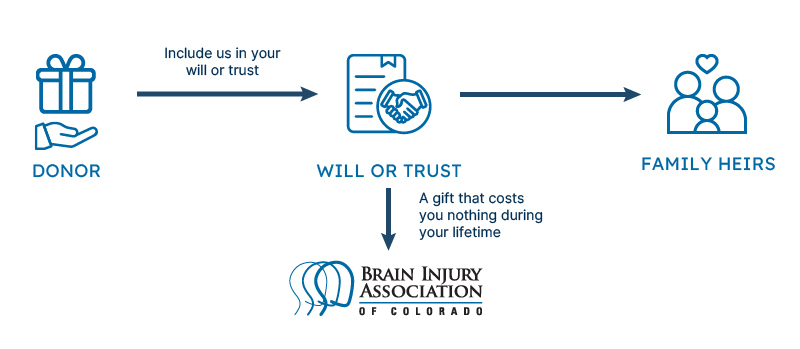

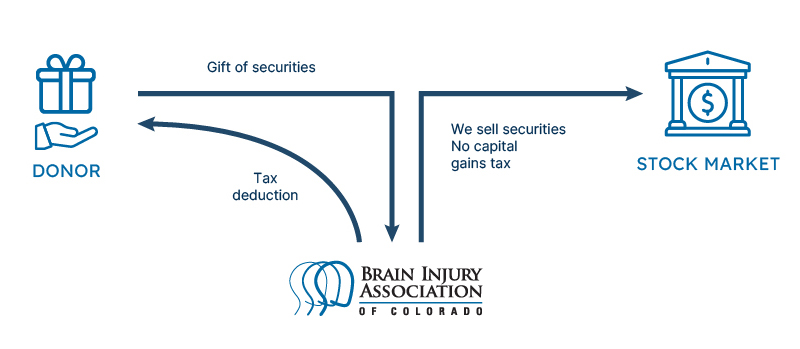

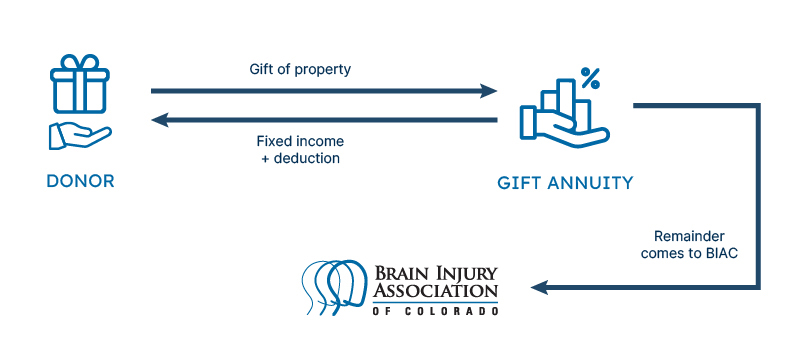

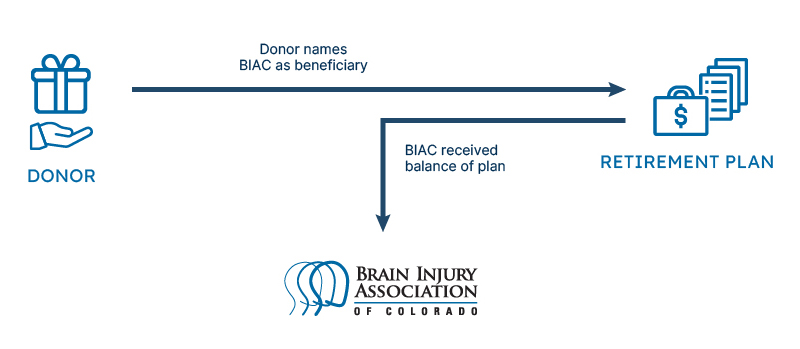

Planned giving provides security and benefits to our donors and the Brain Injury Association of Colorado. Many planned giving options provide financial benefits to the donor that far exceeds the value of the actual contribution. The Internal Revenue Service provides generous incentives for charitable gifts made through estate planning. Some of these gifts can provide lifetime income to the donor (or others) while generating charitable deductions against taxes on ordinary income and capital gains.

Most Popular Planned Gifts

Where to Begin?

For more information please contact Zach Hudson.

Phone: 720-996-0520

Email: Zach@BIAColorado.org